Reflecting on the year 2022, how will we remember it a decade from now? Will it be seen as the year when the global economy recovered from the impact of COVID-19? Or will it be remembered as the year when inflation soared, and interest rates experienced unprecedented increases? In the insurance industry it will surely be the year in which the global insurance landscape experienced unprecedented changes, which significantly impacted our financial performance.

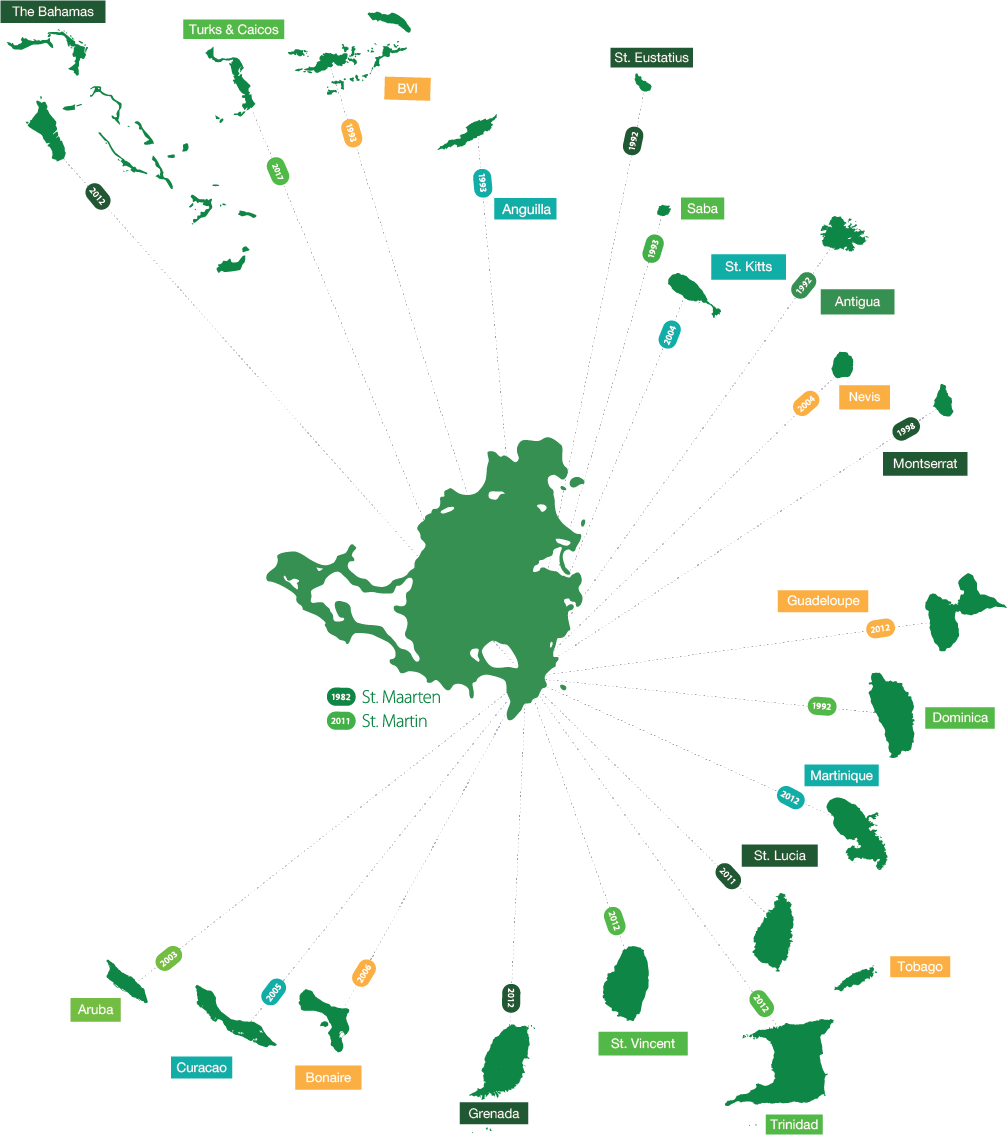

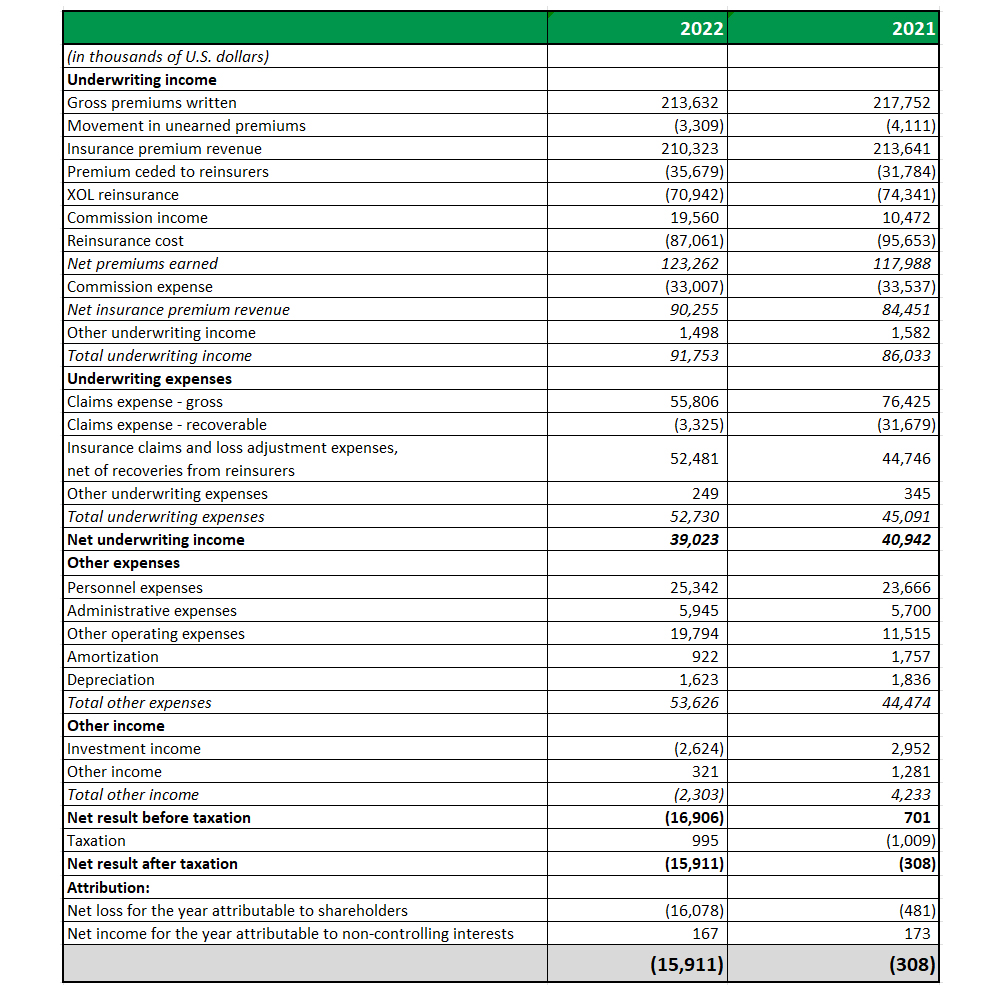

Our total premium written amounted to US$ 212 million, a decrease from the previous year’s US$ 217 million. This decline can be primarily attributed to our Property Insurance business, which underwent substantial risk reduction measures in high/medium wind-exposed areas.

On the bottom line, we faced challenges and recorded a loss of US$ 12.6 million. This loss resulted from a convergence of several factors, which I will address, focusing on the most significant ones.

One crucial factor was the surge in reinsurance costs, driven by the escalating risks associated with climate change and catastrophic events. To ensure the highest level of coverage for our policyholders and maintain our commitment to risk management, we made difficult decisions to secure necessary reinsurance at elevated prices. While we passed on a significant portion of these increases to our policyholders through rate adjustments, we also retained a considerable portion of these costs, leading to a $4.9 million loss in our Property Insurance segment. Throughout the year, we actively reduced our overall exposure to Windstorm risks, thereby mitigating losses in this line of business. Looking ahead, we anticipate further rises in reinsurance costs in 2023, necessitating passing these increases on to our customers. In return, we will ensure our protection with a first-class reinsurance placement that will enable us to weather even the most severe natural events.

Another challenge we faced was an increase in motor accidents as people resumed regular travel post-pandemic. Rapid inflationary pressures presented an unforeseen challenge as repair costs surged beyond our projections. The rising costs of labor, parts, and materials directly impacted our claims expenses. Furthermore, global supply chain disruptions resulted in extended repair times. Consequently, our Motor line of business ended the year with a loss of US$ 4.9 million.

Despite these difficulties, our medical business performed well in 2023, posting a profit of US$ 1.8 million under tough market conditions. Swift underwriting actions and rate adjustments enabled the portfolio to generate a modest profit, even amid similar inflationary pressures. We were also pleased to see that certain accounts, previously lost to competitors, returned to NAGICO due to our unmatched service levels.

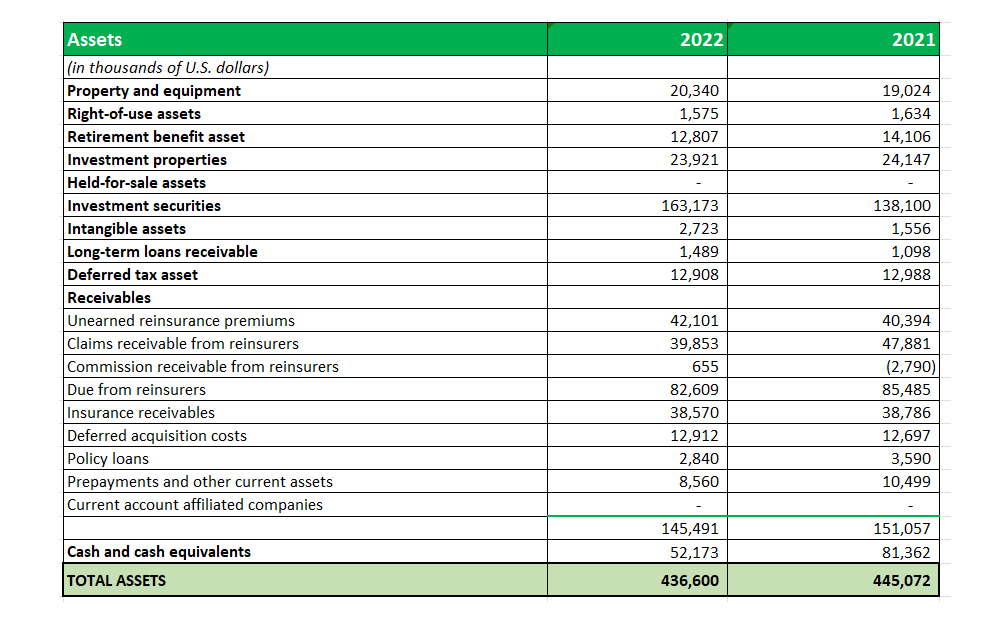

The volatility in global financial markets, fueled by rising interest rates, presented significant challenges for our investment portfolio. Although our investment strategy is designed for sustainable long-term returns, it encountered headwinds during the review period. Our Investment Portfolio recorded a loss of US$ 3.2 million. However, it’s important to note that these mark-to-market losses reflect temporary adjustments and do not accurately reflect the true underlying value of our portfolio. We remain committed to maintaining a well-diversified portfolio and a disciplined approach to risk management. Leveraging our expertise in investment management, we are confident in our ability to navigate uncertainties and deliver robust returns in the future.

Organizationally, we made substantial investments during the year. We restructured our Finance division and invested in Operations and Technology resources. Additionally, we expanded our team with Life Distribution and Technical Underwriting resources. We initiated in-depth analyses of work processes and conducted gap analyses in system requirements. All these investments will contribute to improved process efficiency, automation, and profitable growth in the years ahead.

We anticipate improvements in our Property Insurance segment through continued risk reduction in high/medium wind-exposed territories and rate adjustments. For Motor Insurance, we expect a turnaround in 2023 and 2024, facilitated by the application of sophisticated pricing, analytics, and segmentation strategies. Technology investments will enhance our competitiveness in the Medical Insurance sector. Furthermore, the investments in our Finance Division are expected to yield improved investment results and optimize cash management.

In line with our commitment to innovation and adapting to changing market conditions, we have enhanced some of our Term Life products and introduced new Life riders, including Critical Illness and a Saving rider. Additionally, we have several other product initiatives in progress for 2023, as rising interest rates create new opportunities.

In closing, I would like to extend a special note of gratitude to our dedicated staff, producers, and directors. Without your hard work and unwavering dedication, our company would not have been able to weather the financial storm of 2022. However, our deepest thanks go to our valued customers. Your loyalty and trust are what make NAGICO “Fast, Fair and Always There.” We understand the importance of continually earning your trust year after year, and we will strive to do so for many years to come.